31+ mortgage debt to income ratios

Youll usually need a back-end DTI ratio of 43 or less. The other option is to restrict the.

What S A Good Debt To Income Ratio For A Mortgage

Debt-to-Income Ratio and Mortgages.

. A higher ratio could mean youll pay more. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Heres how lenders typically view DTI.

Usually conventional mortgage loans need a qualifying ratio of 2836. Web Generally a good debt-to-income ratiois around 36 or less and not higher than 43. FHA guidelines call for front-end DTI ratios of no more than 31 or back-end DTI ratios no greater than 43.

Web An FHA loan is a type of mortgage backed by the Federal Housing Administration FHA. Web Lets look at a real-world example. Based on your monthly income of 6000 your back-end.

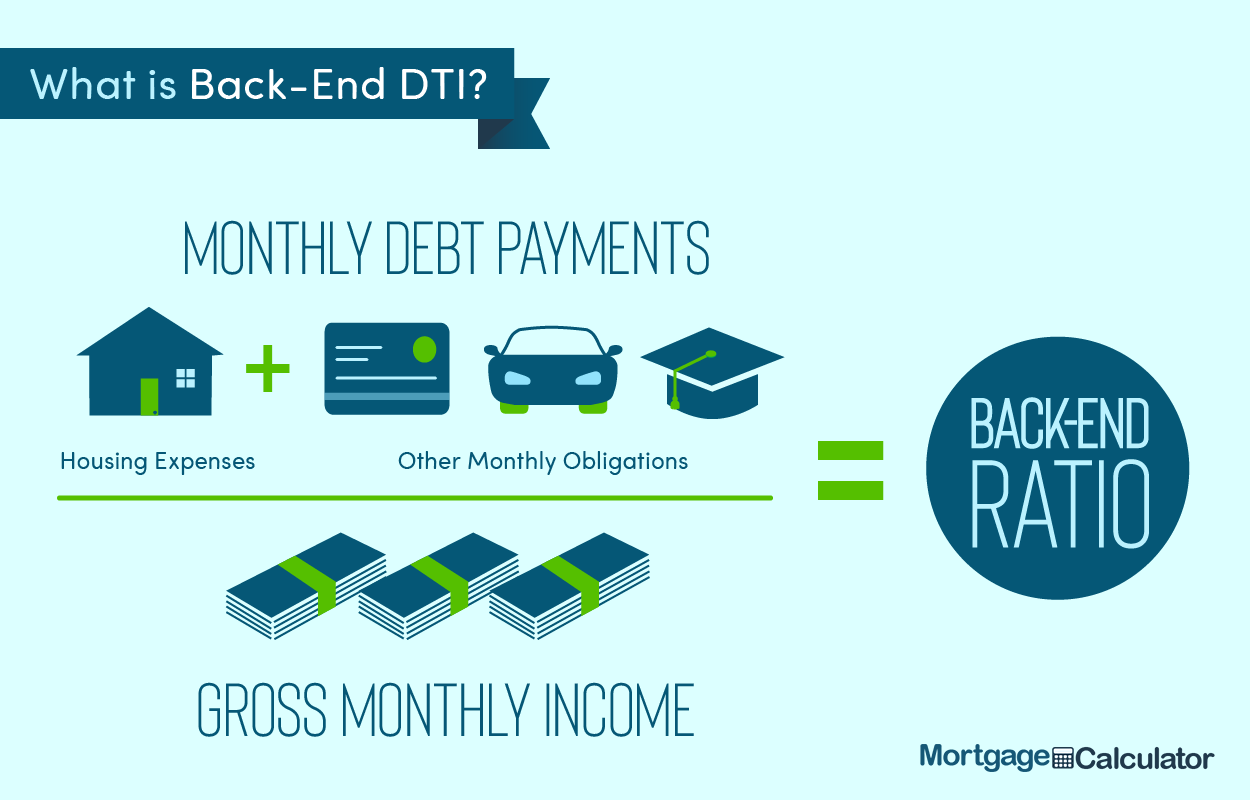

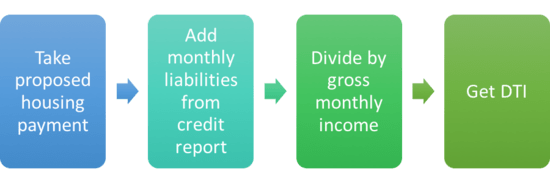

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. If your home is highly energy-efficient. There are two ratios a front ratio which consists of your proposed housing.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web Combine that with your 1800 in monthly housing expenses and you get 2650 in total monthly debts. It is important to note that for example an.

Web Debt to income ratios are just what they sound like a ratio or comparison of your income to debt. Web The debt-to-income ratio is used as part of the credit analysis process to determine the credit risk of an individual. But each mortgage lender can set its own eligibility requirements and DTI.

Web If implemented borrowers would have to earn a gross income of 222222 for lenders to finance the purchase of a 1 million home. Web Understanding Debt-to-Income Ratio for a Mortgage A good DTI ratio to get approved for a mortgage is under 36. Web Here are debt-to-income requirements by loan type.

FHA loans are a little less restrictive requiring a 3143 ratio. Web How to figure the qualifying ratio. Each lender has its own DTI ratio that it considers safe for a home loan applicant to have.

1 2 For example. 130 minimum monthly payment. Web Find out how debt-to-income ratio works and what yours should be at if applying for a mortgage.

Web What Is A Good Debt-To-Income Ratio For A Mortgage. To qualify for an FHA loan you generally must have a FICO score.

What Is A Good Debt To Income Ratio For A Mortgage 2023 Consumeraffairs

Debt To Income Ratios Home Tips For Women

Debt To Income Ratio Dti What It Is And How To Calculate It

Calculating Your Debt To Income Ratio How To Guide

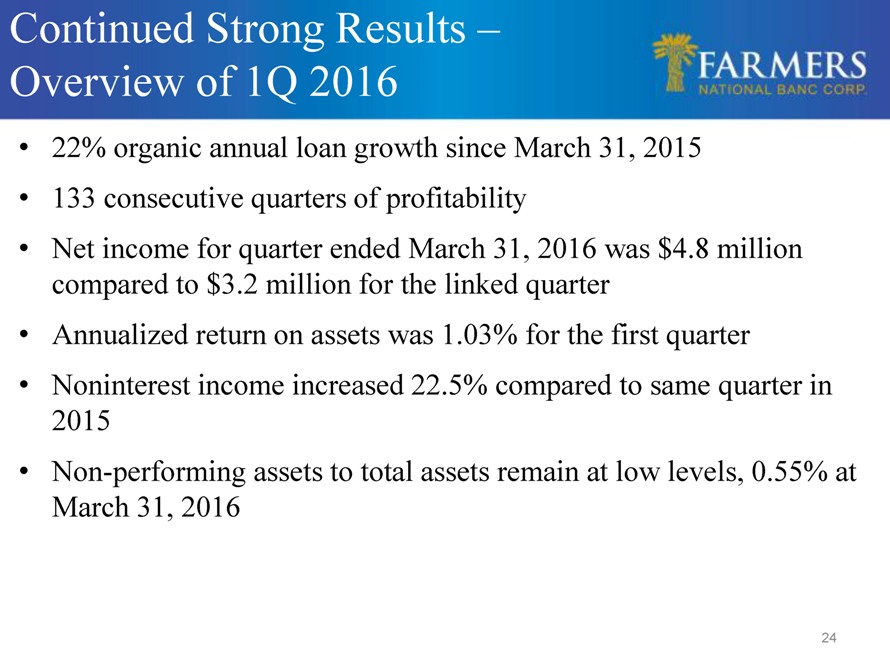

Ex 99 1

Pdf Inequality Household Debt Ageing And Bubbles A Model Of Demand Side Secular Stagnation

What Is The Debt To Income Ratio Learn More Citizens Bank

Axos Financial Inc Axos Financial Inc Fixed Income Investor Presentation February 2022 Nyse Ax Filed Pursuant To Rule 433 Registration No 333 253797 Issuer Free Writing Prospectus Dated February 16 2022 Relating

Debt To Income Ratio Calculator Lowermybills

Why Debt To Income Ratios Are Worse Than They Appear Seeking Alpha

How Much Of Us Income Goes Towards Debt Servicing Quora

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Handbook Final Qxd Securitization Net

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Debt To Income Ratio Calculator Moneygeek Com

Debt To Income Ratio Dti What It Is And How To Calculate It